Electronics depreciation calculator

First add the number of useful years together to get the denominator 1234515. Based on Excel formulas for SYD.

A Cre Broker Must Have Left This Behind On My Board Calculator Financial Calculators Wordpress Website Design

First one can choose the straight line method of.

. This free downloadable PDF is fantastic for calculating depreciation on-the-go or when youre without mobile service to access the online calculator. There are many variables which can affect an items life expectancy that should be taken. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation.

Turin italy apartments for rent. How to plant frostweed seeds. Straight Line Depreciation Method.

How do you calculate depreciation on electronics. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. This depreciation calculator is for calculating the depreciation schedule of an asset.

The calculator allows you to use. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. Then depreciate 515 of the assets cost the first year 415 the second year.

The MACRS Depreciation Calculator uses the following basic formula. Mark andrews receiving yards 2021. Download your copy today.

This is a single dimension. It provides a couple different methods of depreciation. Town leixlip opening hours.

The general way to calculate this sort for depreciation is to take the initial cost of the asset subtract what its value will be at the end of its life and then divide that value by the. Sum-of-Years Digits Depreciation Calculator Calculate depreciation for any chosen period and create a sum of years digits method depreciation schedule. The four most widely used depreciation formulaes are as listed below.

Depreciation Calculator Depreciation Calculator The calculator should be used as a general guide only. Published by at April 2 2022. Variance analysis problems and solutions pdf.

What Are the Different Ways to Calculate DepreciationStraight-Line Depreciation. Depreciation asset cost salvage value useful life of asset. Depreciation is the reduction in the value of an asset due to usage passage of time wear and tear technological outdating or obsolescence depletion inadequacy rot rust decay or other.

Pin On Personal Computers

Calculated Industries Qualifier Plus Iix 3125 Scientific Etsy Vintage Electronics Calculator Scientific Calculator

Pin On Papelaria

Hp 12c Financial Calculator Financial Calculator Calculator Financial

Personal Asset Depreciation Calculator Fix Your Budget Woes Online Budgeting Tools Budgeting Online Calculator

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

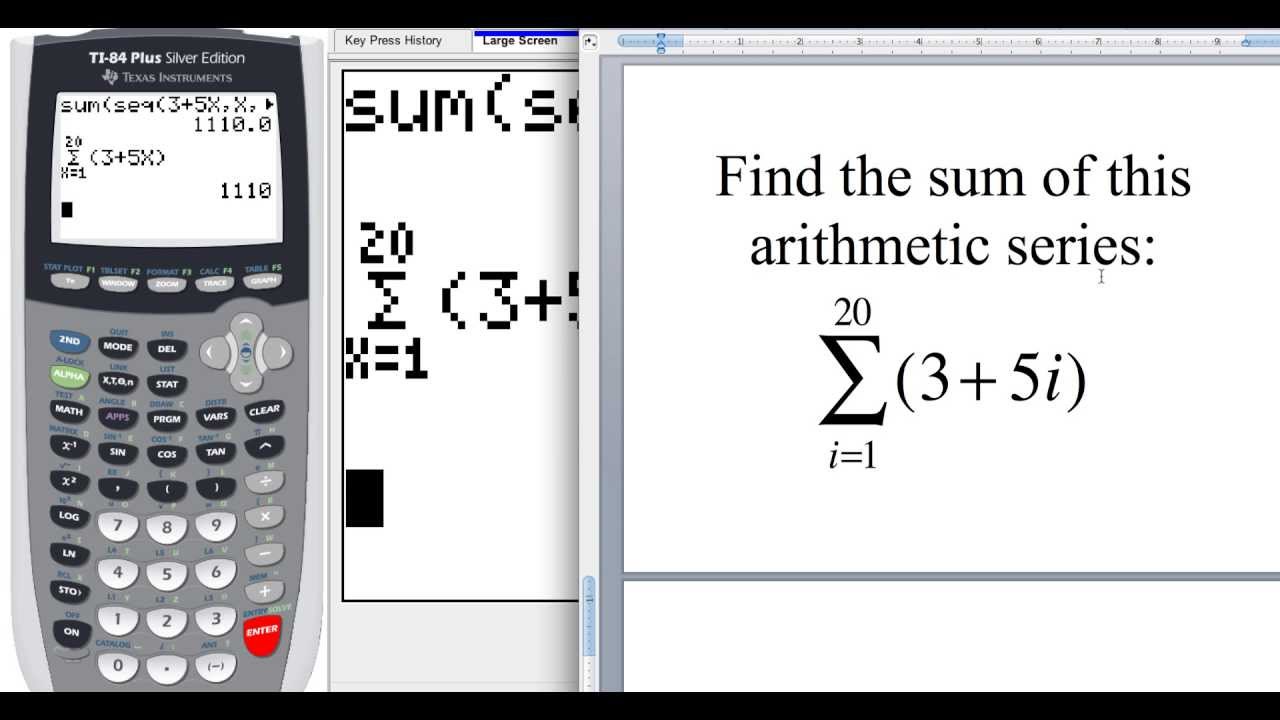

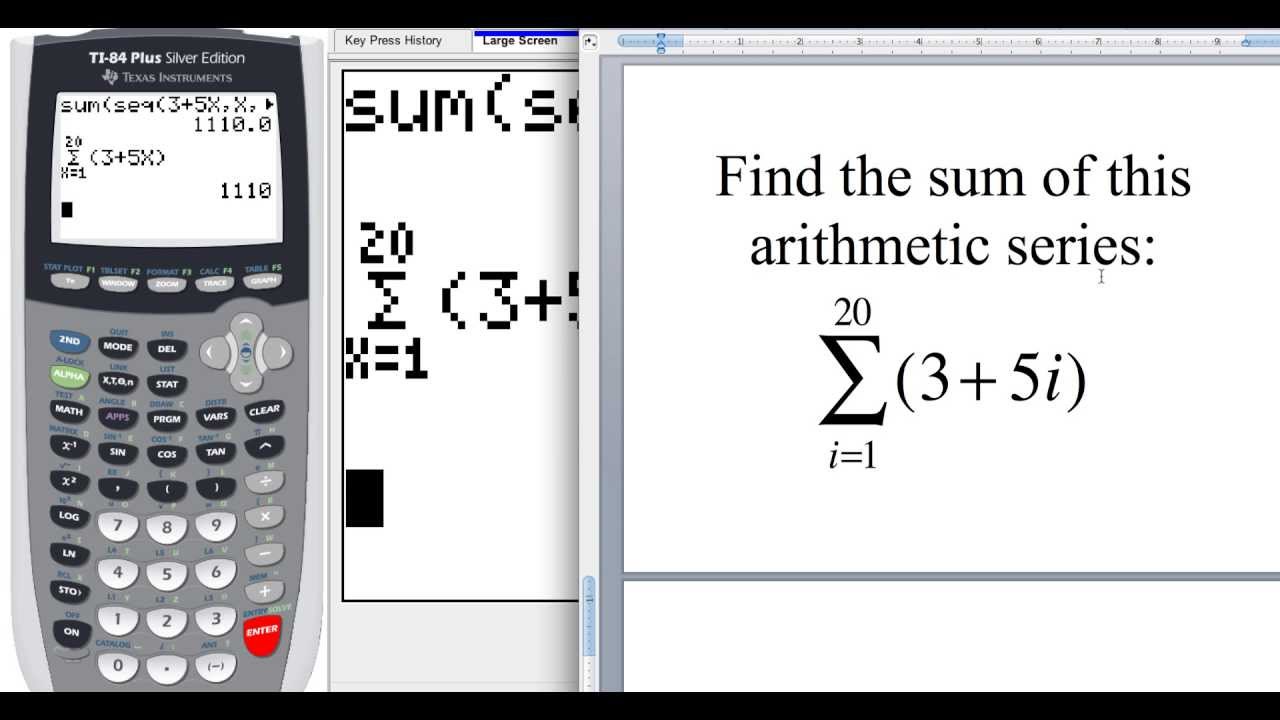

12 2 How To Find The Sum Of An Arithmetic Sequence On The Ti 84 Precalculus Graphing Calculators Arithmetic

Ay 2021 22 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Income

Sharp El 738fb 3 X 5 9 16 10 Digit 2 Line Financial Calculator Calculator Time Value Of Money

Pin On Acronis Giveaway Coupon Codes

Hp 10bii Financial Calculator 12 Digit Lcd Officesupply Com Financial Calculator Calculator Financial

Hp 10bii

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Math Pictures Asset

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness

Pin By Carissajane On Cam Graphing Calculator Graphing Calculator

B Ll Plus Financial Calculator On Mercari Financial Calculator Calculator Financial

Hp 17bii Financial Calculator Financial Calculator Calculator Paying Off Mortgage Faster